Search -

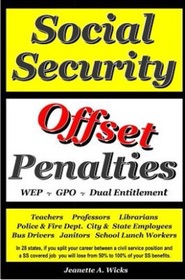

Social Security Offset Penalties: WEP- GPO - Dual Entitlement

Social Security Offset Penalties WEP- GPO - Dual Entitlement

Author:

If you have worked in a civil service position in any of the 28 states with a private pension plan — Those who will pay offset penalties are the: School Teachers (the largest group) - State College Professors - Librarians - Police & Fire Departments - City & State Employees working in the Water Department, Sewer ,Street- an... more »

Author:

If you have worked in a civil service position in any of the 28 states with a private pension plan — Those who will pay offset penalties are the: School Teachers (the largest group) - State College Professors - Librarians - Police & Fire Departments - City & State Employees working in the Water Department, Sewer ,Street- an... more »

ISBN-13: 9780998698649

ISBN-10: 0998698644

Publication Date: 10/13/2017

Pages: 300

Edition: 1

Rating: ?

ISBN-10: 0998698644

Publication Date: 10/13/2017

Pages: 300

Edition: 1

Rating: ?

0 stars, based on 0 rating

Genres:

- Business & Money >> Finance >> Wealth Management

- Business & Money >> Personal Finance >> Retirement Planning

- Uncategorized >> Personal

- Engineering & Transportation >> Accounting & Finance >> Accounting